|

I appreciate you taking the time to comment. I think your mindset is bought my cash can i get a repair loan what its all about. I had one my last year of college, and within a few years it had accrued tons of interest – I think over 25% of the value of the loan. I wasn’t obsessed with money; I was obsessed with freedom. We ask that you stay focused on the story topic, respect other people's opinions, and avoid profanity, offensive statements, illegal contents and advertisement posts. Pretty soon you will be paying off mortgages in a year or less with all the cash flow coming in. He has told them he is giving up his title and to stop calling him and his references, but they won't do it. However, they helped pay my student loans. I had a friend like this – she knew she’d have debt of over $100,000 by the time she graduated law school. I soon became hell-bent on getting out of debt. My mother and stepfather didn’t allow us to move home after college. I locked in with a really low rate and would prefer to pay off my house. I am working to pay off my remaining 55k in 4 years. We are working on paying down our mortgage, and we plan to splash out on a nice vacation, too. For me it’s about making more money and I can only cut back so much right now. Please refer to Bankrate's privacy policy for more information regarding Bankrate's privacy practices. Wells fargo cds offer a choice of terms, bank cd rates guaranteed fixed rate, and interest. Several years ago, the Department of Defense outlawed title loans for service personnel because of abuses and nosebleed interest rates. So for that year, anything extra would (usually) go toward my debt, and if it didn’t, I’d be a little peeved at myself. Even $25/month adds up over time and can usually be carved out of your existing budget without too much pain. You’ve more than doubled your return by getting a mortgage instead of paying cash. If you pay cash versus getting a loan, your returns decrease dramatically and all the benefits of owning rental properties decrease as well. When I first graduated and realized I had looming debt, I was still working at my college job (where I was being paid 10/hour) for six months. If you buy a $100k house with cash and make $500 a month in cash flow, you are making about 6% cash on cash returns. When I started grad school, I was on a $15k/yr stipend and then I also got a one-time award of a couple thousand dollars. If I got a tax refund, half of it went to the loan, and so on. If your credit is bad or, fair, average or great. Of course you want those loans dead and gone – but life happens quickly. Actually, we’re pretty lucky to have our parents to help us save money on rent. If you buy a $100k house and put 20% down, you will have a mortgage payment, but the returns on your cash invested increase. Like my return but now thinking I could have an even better return if I had financed it.

Then my now-husband went back to school and we re-evaluated. With high interest rates and fees adding up each month, he could end up owing much, much more than the few hundred dollars he likely borrowed. Bankrate's content, including the guidance of its advice-and-expert columns bought my cash can i get a repair loan and this website, is intended only to assist you with financial decisions. Title loans tend to be short-term and are regulated by state laws. All Models Of Used CarsIn only 4.5 years you will have a house paid off free and clear plus two other homes producing income. Since that time, the college prepaid plans in Florida have skyrocketed. After 2 years of payments, we are down to ~$146 (interest is about $15k a year in addition to the principal payoff), and anticipate paying them off within 4.5-5 years. I am pretty young and I realize I would rather sacrifice a little independence now for my financial well being in the future. About Contact Press Privacy Policy Terms of Service. I enjoyed the heck out of my 20′s but am paying for it in my 30′s. When you’re salaried, you’re bought my cash can i get a repair loan not paid by the hour. I really hate debt, but not keeping up with the savings habit I had been raised with was also a debt in my mind. If I knew I could do it in one year of tremendous sacrifice, I’d totally do it. Sure, if you want to pull out the “you weren’t really ready to buy a house then” card, feel free to. GetRichSlowly.org makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors or omissions in this information or any damages arising from its display or use. It’s been hard and I am trying to cut back more and more and hustle. For those looking to build wealth quickly I think leverage is the way to go, as long as you follow your guidelines and buy for cash flow. You’re taking advantage of an opportunity more than you are making a sacrifice. While I technically could have taken a trip or lived in a better apartment or worn better clothes, not having any debt was more important than any kind of lifestyle improvement at that time. I think that 1.) you can’t finance your retirement, and 2.) worst case scenario, you can always use the money in your ROTH to pay off your student loans. Philippines Cell 8.9Please avoid posting private or confidential information, and also keep in mind that anything you post may be disclosed, published, transmitted or reused. I could easily afford to rent a place downtown and pay my loans for the next decade or two. Bankrate wants to hear from you and encourages bought my cash can i get a repair loan thoughtful and constructive comments. It would be another big mistake to rely on the lender to tell him what his options are. My lender makes me wait a year, like most. Having poor credit should not deter poor credit home loans you from seeking a mortgage loan. That’s a fantastic accomplishment–and one that is far from reachable for most of us. The latest gold prices by different currencies kuwait gold rate today in different countries in the world. That’s when I met my husband and married close to 200k in debt. Were there some sacrifices, yes absolutely. Since 1973 when i first became a Realtor, buying sfr’s as rentals was generally a wise move depending on the deal, of course. But I always ended up feeling guilty about it, although maybe I shouldn’t have, because you should leave room in life for fun, right. Second, he promised to pay good money for something that has turned out to be worthless. So I don’t believe bought my cash can i get a repair loan that for one second. If i buy a fannie mae house cash can i still get a loan to fix it up find in my. With a judgment, the lender could request a wage garnishment (if allowed in your state), garnish a bank account or place a lien on any real property. Our story is similar, but with one twist – my husband had a student loan of $40k, and because of some lost paperwork (on their side.) the lender thought he had defaulted (when he was still in the last year of his PhD), and demanded immediate payment in full. Luckily, my parents didn’t charge me rent. Oh, and I needed a place to live that wasn’t my parents’ and or student housing. Compare personal loan interest rates and features and select the best personal. The IRS lets you depreciate a percentage of your rental bought my cash can i get a repair loan properties every year and write that off as an expense. I agree with a few others that it shouldn’t be considered that big of a sacrifice but it certainly feels like it at the time.

If I wanted to go see my friend’s band play in the hip part of town where I used to live, my mom didn’t care. That was a big motivation for me (being out of debt and still young), and I definitely took advantage of it–one of the few things I did right in my early 20s. The way to make big money in rental properties, is finding properties that will give you big cash flows and buying as many as possible, while leveraging your money. My $12k in student loans aren’t going anywhere fast as a single mother of three kids teaching at a public school. If you can keep buying properties their cash flow will pay down the mortgages even faster. Mostly my roommates were awesome people and I am still friends with several of them–can’t say that about a loan. Thinking about the whole amount bought my cash can i get a repair loan is such an important lesson. The content is broad in scope and does not consider your personal financial situation. I was too busy at the time focusing on the dual mantras of “debt elimination” and “save for retirement” without worrying about other financial goals, like buying a house. I’ve never had substantial credit card debt, so this was my first glimpse of how gratifying paying off debt could be. You do have to put in some very sensitive info, but it is highly guarded and secure. Every month, I pay the minimum and it costs me $1 in interest. I graduated in December 2005 and received my “Hey, we’re about to start charging you interest” letter five months later. But when you’re making $10 an hour and dreaming of moving out of your parents’ house, it sure seems like a nightmare. |

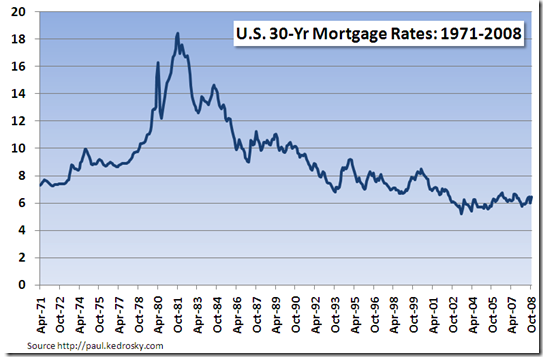

Facing the Mortgage Crisis

Facing the Mortgage Crisis